feature

Most firms have no clue how much it costs them to acquire new customers. They do some marketing, win some deals, and as long as the top line keeps going up — everything seems to be in order.

But what if your bottom line isn’t keeping up with revenue? What if your cost structure is out of whack or you’re paying more to acquire new customers than they’re worth?

Generating new business is critical, obviously — but it’s also critical to understand how much it’s costing you generate that business in relation to what it’s worth in the long run.

What New Business is Really Worth

This may come as a surprise. But the two numbers that predict the future profitability and growth of your business have little to do with revenue, profit, or any of the traditional financial metrics you might be familiar with.

- Customer Acquisition Cost (CAC) – How much does it cost, on average, to acquire new customers? Add up all the money you spend annually on marketing and sales (including salaries, advertising, event sponsorships, etc) and divide by the number of new deals you typically close in a year.

- Lifetime Value (LTV) – How much is a new client worth? Most clients (hopefully) stick around beyond the first deal. How many deals do you usually get out of the average client? What are those deals typically worth? Remove expenses to come up with an average customer lifetime value.

These two numbers will tell you, in no uncertain terms, whether you’re making or losing money on new deals.

Winning Deals vs. Making Money

Acquisition costs and lifetime values are meaningless on their own. They only provide insight when you compare them to each other by calculating your Lifetime Value (LTV) to Customer Acquisition Cost Ratio [LTV:CAC] — which is the relationship between how much you earn from a typical client and how much it costs to acquire that client.

- If LTV:CAC is less than 1 (i.e. your cost to acquire customers is higher than their lifetime value), it’s amazing you’re still in business. Either you’ve found a way to defy logic or you’re headed for a cliff.

- If LTV:CAC is roughly equal (1:1), it’s no wonder you’re scraping by. You’re just barely bringing in enough business to stay afloat. This is clearly not sustainable and you need to find ways to either increase LTV or decrease CAC.

- If LTV:CAC is 3:1, you’re right in the sweet spot. This is where profitability and growth are in perfect balance for most businesses. You’re making money, but you’re still investing in future growth at a reasonable rate. Keep doing what you’re doing.

- If LTV:CAC is 4:1 or higher, you might think you’re in good shape because each new deal is worth 4X the cost of acquisition. That’s an amazing profit margin. But it also means you should be reinvesting more of that profit on customer acquisition. In other words, you could be growing faster if you spent more.

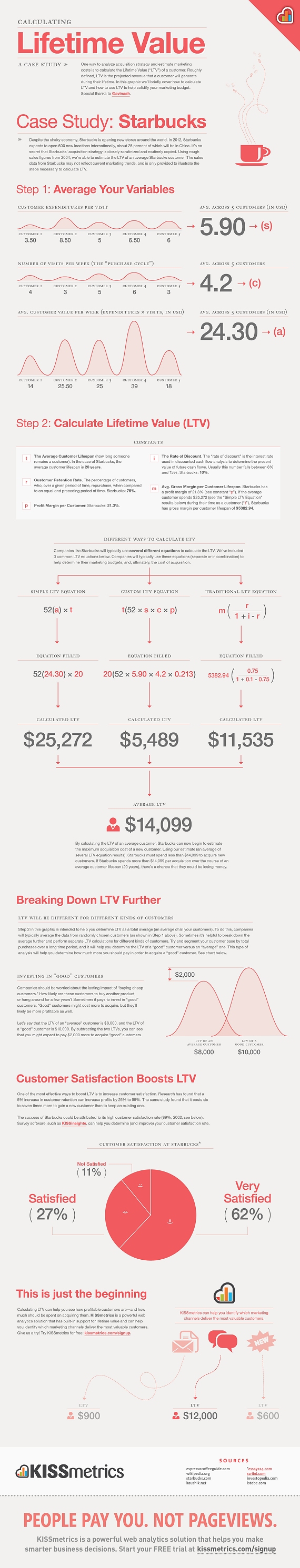

The Lifetime Value of a Starbucks Coffee Drinker

Here’s a real world example of how to calculate the lifetime value of a customer. Fair warning: if you’re a Starbucks customer, the number will evoke a deep sense of regret.

Further exploration:

- The Key to Driving Consistent Growth: Understanding Costs

- Startup Killer: the Cost of Customer Acquisition

- How Much Did That New Customer Cost You?

- How do you calculate your customer acquisition cost?

- The Business of Legal: How Much Does that Client Cost?

marketing

How to Waste $154,980 Advertising in the New York Times

On June 21, Hampton Creek — a food company that makes cookies and mayonnaise — ran a full page ad in the New York Times that went terribly wrong.

In this post, Shawn Coyne — writer, editor, and story teller — breaks down the lessons we can all learn at their expense.

Remember, a well-told Story is like a joke. It promises a specific type of payoff (a specific kind of laugh) with its beginning hook. And after the progressive complications of the middle build, it pays off that hook in an unexpected, but inevitable way (a bigger laugh than we anticipated).

sales

How to Stop Wasting Time on Dead End Leads

Conventional wisdom says to keep your pipeline filled with prospects. But generating leads and selling can be all-consuming, infringing on your work with clients. If, however, you focus on who will give you a fair hearing instead of trying to win business from everyone you come across, you can decrease your sales time, increase your close rates, and give your clients high-quality work.

Two Buyers Who Will Hear Your Pitch—and the One Who Won’t

growth

It’s time to admit that it’s all your fault.

More than we’d probably like to admit so many of our days are spent in a state of self-delusion, an internal monologue of justifying our actions, both good and bad. When we do something wrong, our evolutionary instincts kick in and we do anything we can to not acknowledge the obvious: sometimes, it’s all our fault.